Understanding French Wine: History, Regions & Traditions

April 4, 2025

Uncover the rich history of French wine, from its Roman roots to the prestigious Bordeaux, Burgundy, and Champagne.

By: Barnaby Eales / Last updated: May 2, 2025

Moving from chateau to chateau in Bordeaux, tasting the new vintage, our mode of transport is a Peugeot car dating back to 1982, coincidentally the same vintage Bordeaux’s En Primeur (EP) week became known for.

In the Spring of 1983, wine critic Robert Parker went against popular opinion, saying that the 1982 Bordeaux vintage was ‘a great one’. He rated Mouton Rothschild and Petrus with 100 points. Confounding other critics and tasters, Parker was proved correct; it became a legendary vintage, still talked of today.

During EP week, Bordeaux Châteaux promote their latest vintage through barrel tastings of young wines. Shortly after, in May or June, they announce campaign prices. Buyers and collectors buy wines young before they’re bottled and then pay duty (tax) between 18 and 24 months later when they’ve matured.

Los Angeles wine consultant Andre Holmes and our driver Daniel, a Bordeaux Negotiant, accompany me in the vintage car. Holmes is here to taste and buy wine and is one of Daniel’s clients. Negotiants are wine merchants who buy wine from Bordeaux Châteaux via brokers and sell and distribute it worldwide (more than 300 Negotiants are active in Bordeaux today, read more). In the 18th Century, they also bought grapes directly from their owners.

The Union des Grands Crus Bordeaux (UGCB), the promoter of the top estates, established EP Week in the 1970s during the oil crisis, but it didn’t become popular until the 1982 vintage. EP Week is a massive marketing and business campaign showcasing wines and the model of the Place de Bordeaux, the Bordeaux marketplace, which will be a €1.4 bn business in 2024.

Toward the end of April every year, around five thousand critics, buyers, and journalists head to EP Week, tasting hundreds of wines and writing tasting notes that may influence the Les Primeurs prices, which the Châteaux establish just weeks later.

It’s the perfect time to celebrate Bordeaux, see the appellations and Châteaux, and experience dozens of tastings beyond the Grands Crus Classes wines, held by collective organizations of producers from each appellation, including Cru Bourgeois producers.

In the post-WWII years, cash-strapped Bordeaux Châteaux needed revenue upfront to finance the production and aging of wines, and EP wine sales to negotiants provided them with a vital cash injection. In the 21st Century, that’s all changed. Many of the top-rated Châteaux are owned by blue-chip companies and banks.

The recent rise in interest rates has heightened financial risk for négociants, while sluggish demand has led to an accumulation of unsold wine stocks. For the first time ever, Negotiants, holding unsold stock from the 2020 vintage onwards, refused in 2024 to buy allocations from Chateaux, French weekly magazine Le Point revealed in December 2024. If in 2020, 212 Chateaux sold all of their allocations, only 50 (15%) did so in 2024, Le Point said.

US clients like Holmes, with whom I traveled to taste En Primeur wines, are increasingly important to Negotiators as interest from the Chinese market in Bordeaux has waned. During a recent EP campaign, I noticed two buyers emerging from a private meeting at the highly regarded organic Grand Cru Classé estate, Domaine de Chevalier.

Barring a handful of the first growths and super second Grand Cru Classe wines, the EP days when you were guaranteed a return from buying new vintage wine in its youth and selling them on once mature have long gone. Value is to be found beyond the big Châteaux names and the hierarchy of classifications.

Philippe Tapis, Chairman of Bordeaux Négoce, L’Union des Maisons de Vin, told the French business newspaper Les Echos in June 2024.

“Les Primeurs make no sense without large volumes and the assurance that the customer will pay less,“

“Why should the Negotiant continue to finance the cash flow of Châteaux for forty-eight months if they can’t be sure of getting their money’s worth?“

In recent vintages, wine volumes have been hit with lower yields resulting from disease in the vineyards, notably mildew, in 2021, 2023, and 2024.

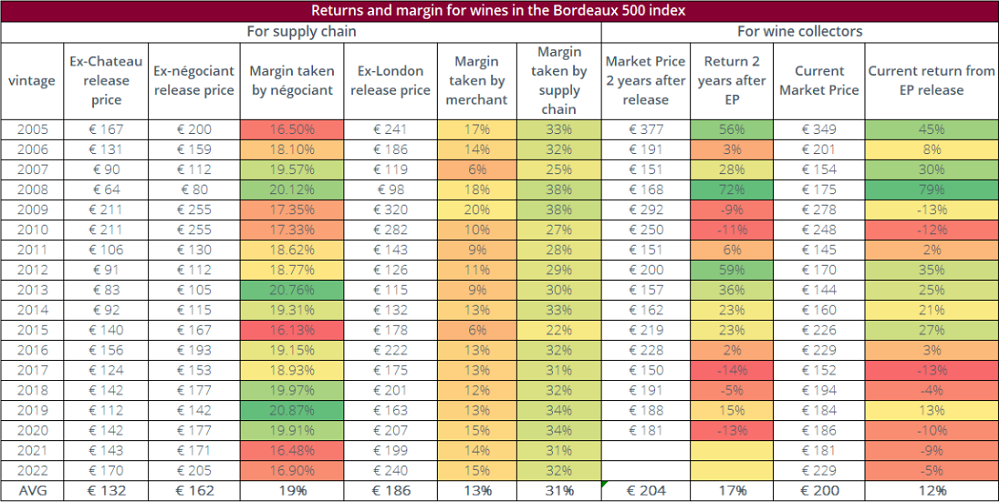

Meanwhile, buyers who purchase En Primeur too often see the same wines enter the physical market at the same or lower prices. In four of the five vintages between 2018 and 2023, market prices were lower than at the time of their EP release.

Between 2019 and 2022, Bordeaux Châteaux increased prices, sparking criticism in the market, where enthusiasm for claret has worn thin. Older vintages, ready to drink, were being sold at lower prices than the price of En Primeur, making buying prospects largely redundant.

With slowing demand, tensions between Negotiants and Châteaux owners have risen. Negotiants complain about a move by some Châteaux to limit volumes and set prices too high. They are also reducing the amount of wine EP offers by favoring drip-feeding more mature vintages onto the market.

Liv-ex, a wine marketplace, tracks the daily price movements of the Bordeaux First Growths in its Fine Wine 50 index. This benchmark has declined 24% in two years (2022-2024) after a post-COVID boom and is 9.2% lower than five years ago.

Over five years, prices of Bordeaux’s finest wines have trailed those of other regions, particularly Burgundy and even Champagne.

In its report ‘Bordeaux in the Balance’ of April 2024, Liv-ex’s chart (see full PDF report) shows the returns and margins for leading Bordeaux wines purchased by En Primeur, going back to the 2005 vintage.

According to Liv-ex, the 2019 vintage was the last to reap the rewards for collectors, a highly rated vintage released into the eye of the Covid storm. It said that in 2023, buyers were rewarded with returns of 13% since release.

Along with volumes, EP wine prices are the key factor affecting sales; traders want to know about prices for each EP campaign. Liv-ex says the problem with EP is that there is no price-setting mechanism and no book-building exercise like in financial markets or natural markets, where prices are set according to demand and supply.

In April 2024, Liv-Ex director James Miles told the Areni website that Château pricing does not align with international markets. After years of rising prices, the 2023 vintage saw an average 22% decline in 2024. However, the price reduction failed to stimulate buyer interest in Bordeaux fine wines, sales of which have been hit by a global fall in red wine consumption and uncertain geopolitical and economic crises.

Jean-Valmy Nicolas, manager at Château La Conseillante, a top estate in the Pomerol, told Les Echos in July 2023.

“For one of the best vintages in terms of quality in the last five years, it was the worst campaign in 30 years.”

This view was echoed by Emmanuel Cruse, MD, at Vignobles Cruse Lorenzetti, an owner of several organically farmed Grand Cru Classe estates.

Lorenzetti told a wine publication:

“I’ve never seen anything like it. Sales results are catastrophic. Our biggest markets, the US, Europe, and China, are all down at the same time.“

Reflecting trade sentiment of recent years, Max Lalondrelle, Bordeaux wine buyer for Berry & Bros, says EP trade for the London wine merchant has flatlined since around 2013 to between £5 and £10m each year, a far cry from trading the 2009 vintage when the company’s EP turnover reached £62 million.

Producers suggest that a further price fall in the forthcoming EP campaigns will rekindle consumer interest in Bordeaux; however, that is not what Châteaux necessarily want.

Speaking to Figaro newspaper in July 2024, Nicolas Robl, MD of producer Le Dome in Saint-Emilion, said buyers wanted 50% price cuts, which he refused to offer.

Announcing it would not sell wines En Primeur, Robl said.

“Dropping prices to that extent would have ruined our brand [in terms of market positioning] and put distributors and importers into financial difficulty. Galvanizing consumer interest in Bordeaux by connecting with the final consumer is now the focus of the Union des Grands Crus.“

Hit by declining sales of red Bordeaux, the Place de Bordeaux has expanded with negotiants selling and distributing wines from other countries, as it aims to become a global hub for wine. Once confined primarily to Bordeaux wine, En Primeur sales in the Place de Bordeaux now include wines from elsewhere. For instance, non-Bordeaux wines from Spain, Italy, and South America are sold EP in the Autumn and never at the same time as the EP Bordeaux wine Spring campaign. That move has triggered a bitter response from Bordeaux producers in difficulty, who claim the commercial focus of the trade should be on Bordeaux wines.

Meanwhile, digital platforms are now facilitating the En Primeur process, from online bidding to streamlined contract management. In 2021, Vindome became the first company to sell Bordeaux wines En Primeur live via its app. In June 2024, Web3 platform InterCellar launched several Bordeaux En Primeur wines as non-fungible tokens (NFTs) through the Crypto.com exchange, the first of its kind in the traditional En Primeur campaign.

With the secondary market awash with older Bordeaux vintages selling at lower or the same prices as younger vintages, there’s much talk in the wine industry that the EP campaign is on its last legs. A revamp of the EP campaign is more likely. Laying out his vision for En Primeur 2.0, veteran industry figure and writer Robert Joseph has called for market allocations for wine to be staggered. Read more

According to a 2024 survey conducted by fine wine consultancy group Wine Lister, fine wine trade industry figures say they want fewer wines, around 50, to be presented with 30-50% price discounts.

Back on the EP journey in the 1982 reg car, Daniel, the negotiant, is beeping and swearing in French at the huge, stationary 4×4 parked in the middle of the road, holding up traffic. A few minutes later, two Chinese wine buyers in sharp, dark suits and glasses head towards it. Daniel has already given up. He swerves around the car with a screech, and we zoom off to the grandeur of the historic Chateau Beychevelle in St Julien to have lunch.

During EP week, a Grand Cru Château from each Bordeaux appellation serves as the host, offering a refined lunch where guests can taste a selection of young and aged wines from the region. It’s a civilized event showcasing the top French wines and cuisine. Beyond geopolitical and economic tensions, disputes over market prices, production volumes, and the impact of climate change on yields, wine heritage, and Bordeaux’s unique trade structure draw thousands to En Primeur week each year—an experience unmatched anywhere else.

Together with my own experiences and knowledge, here are some references:

If you would like us to customize an exclusive luxury tour, contact us and let us know your travel plans. We offer luxury food and wine tours for private groups of a mininium two guests. In addition, all of our private, chauffeured tours are available year-round upon request.